Are Idaho mortgages entering a rising interest rates market?

By now everyone has heard that we need to beware that Idaho mortgages may see rising interest rates. Local news, financial websites, and your friend at church all seem to agree. But if there’s one thing I’ve learned from being invested in real estate during various market cycles, it’s to take what “everyone is saying” with a grain of salt. That doesn’t mean to ignore it—just be aware that it’s by no means a certainty.

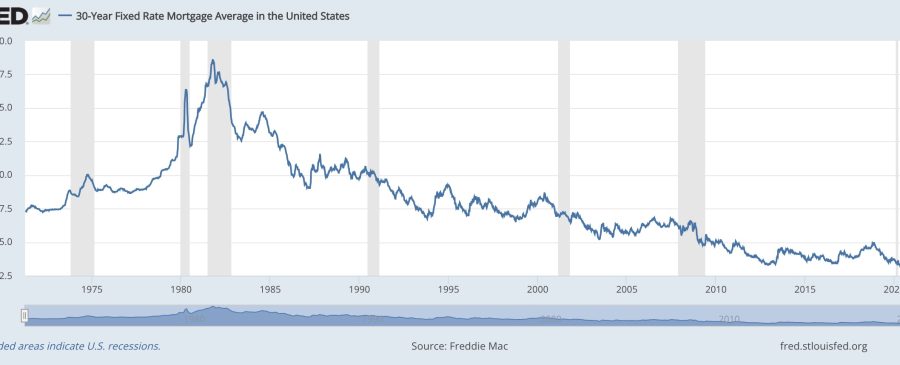

The chart you see here is a chart of national mortgage rates since the 1970s. You can see the huge peak in the early 1980s during the Carter Administration, and it’s subsequent decline in the following decades. It’s abundantly clear that, although there are periods of fits and starts to these rates and they do go up occasionally, the trend is clearly down. And that trend has been in place since they peaked in 1981. That’s a long time.

If you have done any investing in the stock market, you’ll notice that the interest rate chart looks a bit like a stock chart. There are periods of rising interest rates and falling interest rates. Both of these trend lines exist within an overall trend. Now, without getting into the whole debate over fundamental vs. technical stock picking (I believe each have their place in the toolbox of the investor), it should be clear that the overall trend here remains down.

You might ask, and rightly so, how low can they go? Aren’t we as close as we can get to zero? To answer that question, I’ll pose another question to you. How long might it take to get to zero? And what might happen if the Fed rates (which are different from mortgage rates, of course) go below zero? Could the Fed rate bounce around zero for another decade, or perhaps even go into negative territory? Don’t laugh—anytime government intervenes in markets, whether it’s interest rates or mortgage backed securities—weird things are bound to happen.

And then we have the perverse nature of markets, which always seem to do the opposite of what the most market participants think it will do.

I want to be clear that I’m not a fan of government intervention in the interest rate market, but this is the system we have inherited. I’m not writing this to tell you what we ought to do in terms of fiscal policy, but how things actually are right now. And the way they are right now is that rates are still extremely low, and are in a trend that appears to be maintaining those lows.

Could they rise? Of course. Even a year of rising rates may not break the downtrend, though. It could knock some equity off of your home value, of course. But as they say, it’s “only” a loss on paper unless you sell.

On the other hand, if the prospect of short term (or long term) rises in Idaho home loan rates bothers you, and you are fearful of what that might mean to the real estate market, there are two things you could do. If you already own a home, you could sell your home in the hopes of cashing out at the top of the market. If we get enough of a downturn, you may be able to buy back a little lower, with a little luck. If you don’t yet own a home, you could get yourself situation to buy in case there a downturn does materialize.

In my experience, timing any market like that is a long shot. One of my least favorite economists did say something profoundly true. Keynes said that “Markets can stay irrational longer than you can stay solvent.” Consequently, even a really accurate idea of what’s going to happen doesn’t mean an accurate prediction of when it’s going to happen.

Given the politicization of our real estate and mortgage markets, I don’t put it past the Feds to put plenty of lipstick on the pig to make themselves look better. And whether you think that’s for better or for worse in the long term, in my humble opinion, it means relative safety in the short- to mid-term for real estate buyers and sellers. Politicians don’t want to see a career-ending real estate crash. And I don’t think we will.

As of this writing, today’s national 30-year fixed average rate is 3.22%, according to Freddie Mac. According to BankRate.com, the lowest rate in the Idaho mortgage market is 2.875%.

If you are interested in purchasing Idaho real estate, contact me. If you need a home loan, I can refer you to people I know and trust to get you pre-qualified and pre-approved. I don’t get any fees from them—it’s illegal for any agent to do that. I only refer my clients to trustworthy professionals who work hard to get the job done for my clients.

Kevin Harper, Realtor

208-249-8893

Pingback:What would negative interest rates mean to the Idaho real estate market? - 1776 Real Estate | Patriots supporting patriots

Pingback:Why owner carried financing can help buyers and sellers - Kevin Harper Realtor® 208-249-8893