Is the spring housing market about to rebound?

In my last market outlook for HousingWire, published in January, I offered two predictions for the early 2023 retail housing market based on forward-looking Auction.com bidding behavior from the fourth quarter of 2022:

- A home price correction nationwide and in the majority of major markets

- Home sales volume bottoming out

While both predictions have played out in large part (more on that below), bidder behavior on Auction.com in the first quarter turned a sharp corner, indicating a robust rebound on the horizon for the retail housing market. While it’s not as clear how long-lasting the rebound will be, it does still provide some much-needed good news for the spring and summer housing market.

Before diving into more specifics about what Auction.com bidder behavior is predicting for the next three to six months, a quick detour on why auction bidder behavior is a reliable forward-looking indicator for the retail housing market and how that proved to be the case for bidder behavior in Q4 2022 accurately foreshadowing retail market trends for Q1 2023.

A look back: The early 2023 housing slowdown

Bidding behavior on the Auction.com platform provides one of the best barometers of the retail housing market because the success and livelihood of these bidders depends heavily on them accurately anticipating what the retail market will look like in the next six months. These buyers are primarily local community developers who purchase distressed properties and then resell or rent those properties on the retail market following rehab — a process that typically takes about six months.

Auction.com bidding behavior turned sharply more conservative in the second half of 2022, particularly in the fourth quarter, indicating a mild home price correction of less than 5% nationwide in early 2023.

That mild correction has played out, with an emphasis on mild. The national median home price decreased 1.7% in April 2023, according to the National Association of Realtors (NAR). April was the third month with a year-over-year decline in national home prices, and home prices in March were down 9% from the peak in June 2022.

Data from NAR also shows a home price correction in nearly one-third of the 221 markets it tracks in the first quarter of 2023. While not the majority of markets that Auction.com bidder behavior was predicting, the NAR data still shows the corrections were quite widespread, including in major markets like San Jose, California (down 13.7% year-over-year); Seattle, Washington (down 6.3%); Salt Lake City, Utah (down 6.1%); Denver, Colorado (down 3.9%); and New York (down less than 1%).

Lastly, the NAR data from the first quarter also proved out the second prediction based on Auction.com bidding behavior in Q4 2022: a bottoming out of home sales volume. Annualized existing home sales volume dropped to a pandemic low of 4 million in January, but volume rebounded to 4.6 million in February and was at 4.3 million in April.

This article is part of our ongoing 2023 Housing Market Forecast series. After this series wraps, join us on May 30 for the next Housing Market Update Event. Bringing together some of the top economists and researchers in housing, the event will provide an in-depth look at the top predictions for this year, along with a roundtable discussion on how these insights apply to your business. To register, go here.

A look forward: A mid-2023 housing rebound

Enough about how well auction bidder behavior predicted retail market trends in early 2023. What is it predicting for the next six months?

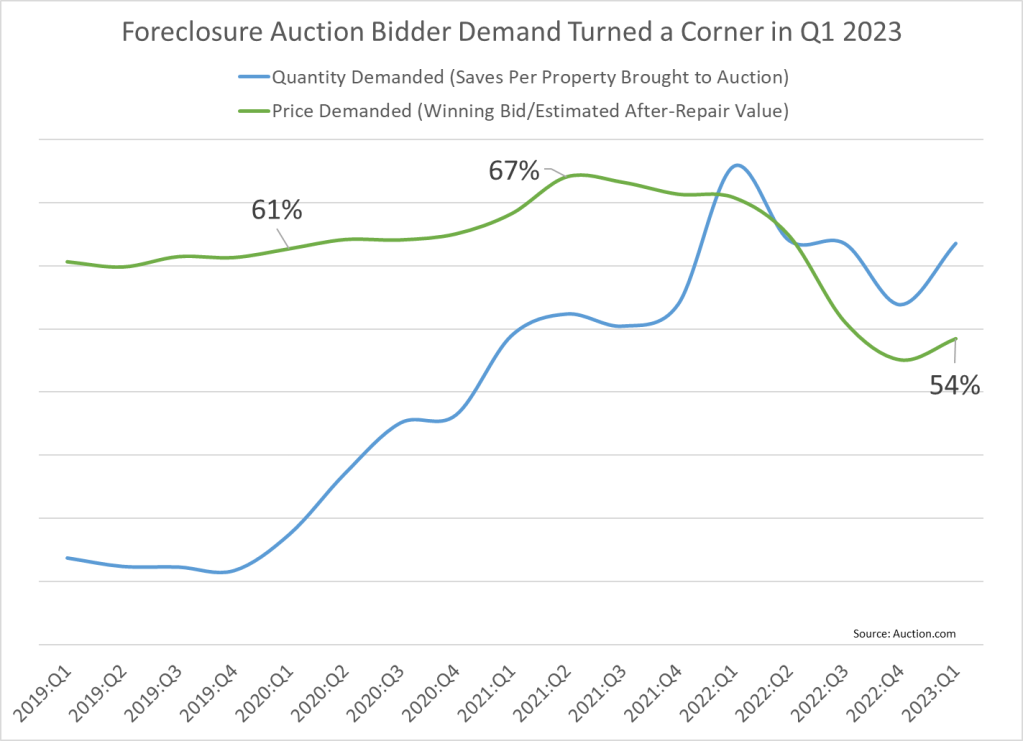

Bidder demand at foreclosure auction turned a sharp corner higher in the first quarter, both in terms of quantity demanded and price demanded. This indicates that home price appreciation will likely rebound back into positive territory in the second and third quarters of 2023.

The quantity demanded metric comes from online saves per property brought to auction. This saves-per-property metric had fallen to a two-year low in Q4 2022 (although it was still well above pre-pandemic levels). But it rebounded 17% in the first quarter, indicating that bidders were starting to open up their buy box a bit after shrinking it rapidly in the face of skyrocketing mortgage rates in the latter part of 2022. Those mortgage rates have stabilized in early 2023 helping to give buyers more confidence and certainty.

The price demanded metric is the winning bid divided by the estimated “after-repair” property value. This price demanded dropped sharply in the latter part of 2022, falling to a pandemic low of 53% in Q4 2022. That drop reflected bidders building a bigger margin into their acquisition pricing in anticipation of softening home prices. But the price demanded rebounded to 54% in the first quarter, an indication that bidders were less concerned about a price slowdown or correction going forward.

It’s important to note that, despite the quarter-over-quarter drop, the foreclosure auction price demanded in Q1 2023 was still well below the when the pre-pandemic average of 60% in 2019. Bidders are still not as bullish about home price appreciation as they were back in 2019.

But they are buying more, with the foreclosure auction sales rate — the percentage of properties available for auction that sell — jumping five percentage points in Q4 2023 from a three-year low in Q4 2022.

Seller pricing caveat

This rising sales rate provides evidence that sales volume in the retail market will continue to rise off its anemic annual pace of 4.0 million in January 2023 — with one important caveat: that home sellers also adjust pricing given the market reality of 6-plus percent mortgage rates for the foreseeable future.

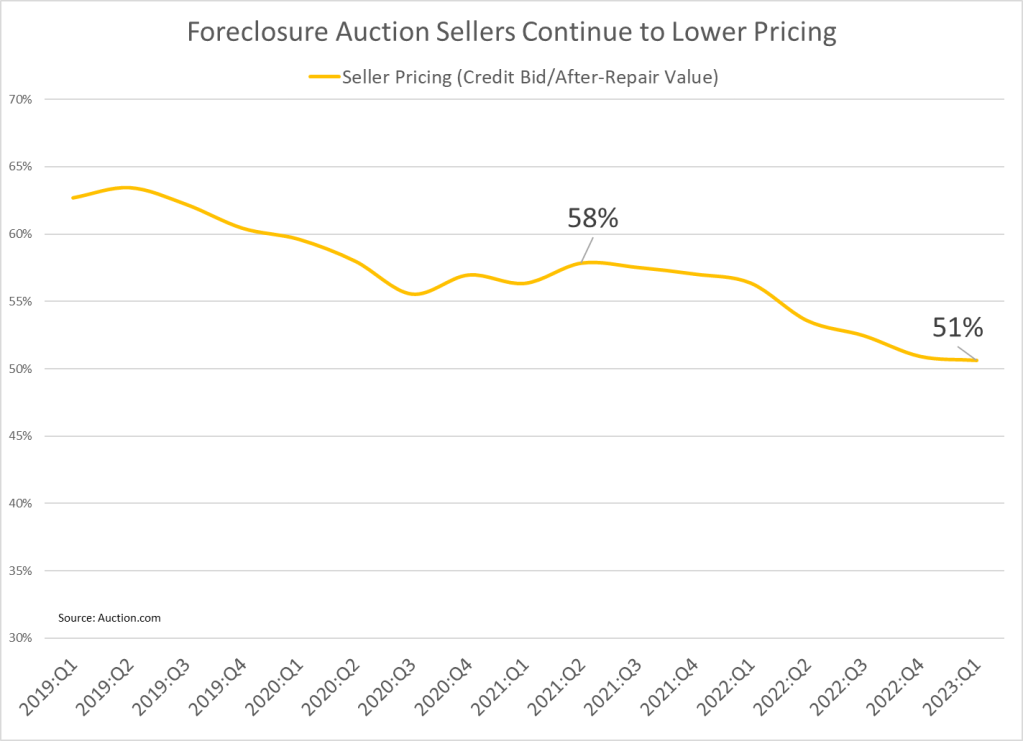

Part of the increase in sales rate at foreclosure auction was thanks to buyers willing to deflate their purchase discount cushion a bit. But part of it was also thanks to sellers willing to listen to the market and adjust pricing lower in response.

The average credit bid – the minimum amount the foreclosing lender is willing or able to accept to sell the property – dropped to 51% of estimated after-repair property value in the the fourth quarter of 2022 and stayed there for the first quarter of 2023. That 51% pricing by sellers was a more than five-year low.

Seller behavior at foreclosure auction is not as predictive of seller behavior in the retail market as is buyer behavior. But if retail market sellers follow the lead of distressed property sellers and capitulate a bit on price, it could make for a much more robust spring and summer housing market rebound.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the editor responsible for this story:

Daren Blomquist at DBlomquist@auction.com

To contact the editor responsible for this story:

Brena Nath at brena@hwmedia.com